Bitcoin dipped by 4% in the last 24 hours amid reports of upcoming U.S. tariffs on key trading partners. President Donald Trump’s tariff announcements have been dramatic enough to keep crypto traders on edge, as Bitcoin and altcoins continue to react to the news.

Bitcoin (BTC) price recovered earlier this week as traders were optimistic about reports that Trump will opt for narrower tariffs than previously suggested. U.S. President Donald Trump spoke with Canadian Prime Minister Mark Carney Friday morning and initial reports are favorable.

Trump said the phone call was “very, very good”, adding “I think things will work out very well.” On his end, Carney’s office said the two sides agreed to begin “comprehensive negotiations.”

Meanwhile, it remains uncertain if Trump will announce additional levies on Canada, China and Mexico on April 2. Until then, traders can expect more volatility and price swings in Bitcoin and altcoins.

Dogecoin (DOGE) and XRP are the two altcoins that held steady amidst steep Bitcoin flashcrashes and Trump’s tariff announcements.

Crypto sectors hit hardest by Trump’s tariff war

Bitcoin has dropped after nearly every major tariff announcement from Trump. However, altcoins have taken a more significant hit, with the combined market capitalization of altcoins down 4% on the day and 23% year-to-date.

The total market capitalization of crypto, excluding Bitcoin, is down nearly 36% from its $1.65 trillion peak on December 7, 2024.

The hardest-hit categories include meme coins, Solana-based and Base-based meme tokens, AI agent, and AI launchpad tokens. Blue-chip meme coins like Dogecoin held on to gains from 2024, while XRP remained resilient after the Securities and Exchange Commission settled its lawsuit for $50 million.

The two altcoins have shown resilience, DOGE and XRP traders have taken profit consistently, even in Q1 2025, amidst the uncertainty from the Trump administration’s tariff announcements and executive orders.

Bitcoin, Dogecoin and XRP are the top 3 crypto winners

Bitcoin held its ground despite tariff announcements, and recovered from four flashcrashes that erased between 20 and 30% of BTC value, this market cycle. Analysts and BTC holders are convinced that the largest cryptocurrency has hit its cycle bottom under $77,000, a multi-month low for Bitcoin.

While Bitcoin hovers around $84,000 on Friday, there is a rise in institutional demand and capital inflow to U.S.-based ETFs. Wall Street’s institutions are keen on adding Bitcoin to their treasury/ balance sheet.

Dogecoin, the largest meme coin in the sector and XRP, the second largest altcoin, had a similar response. DOGE price is up 41% in the last six months and XRP is up nearly 260% in the same timeframe.

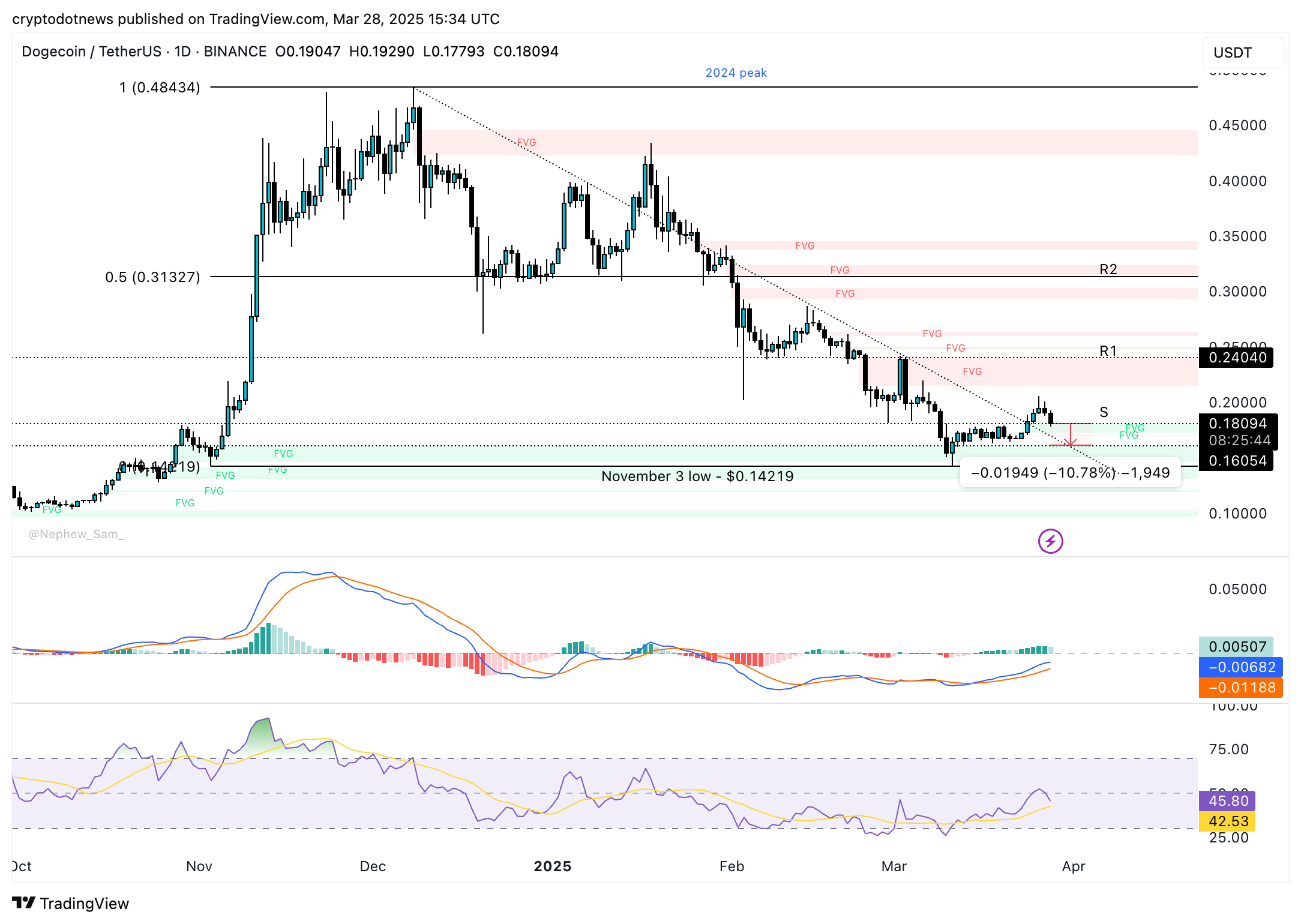

DOGE could test resistance at the $0.20404–$0.21465 imbalance zone. If it corrects, the token may find support 10% lower near $0.16054, the upper boundary of a bullish fair value gap.

Technical indicators on the daily timeframe, RSI and MACD support a recovery in Dogecoin. The meme coin could recover from the 5% price drop on Friday, and re-test resistance in the coming week.

While both altcoins erased their value on Friday and the past week, Bitcoin, Dogecoin and XRP’s long-term holders have had the opportunity to take profits on their past purchases, this market cycle.

XRP’s chart shows potential for a continued decline. The MACD prints red histogram bars above the neutral line, and RSI sits at 42, trending downward, both signaling negative momentum.

Still, XRP holds on to its six-month gains. The SEC lawsuit resolution and a 60% reduction in the proposed settlement have marked partial victories for Ripple.

If the price slips further, XRP could test support at $1.9575 (down 11%), while a rally could push it to $2.5900, an 18% gain from current levels.

Donald Trump’s tariff war has increased pressure on top altcoins, meme coins

U.S. trade tensions escalated amidst tariff impositions and announcements by President Trump. Top altcoins like Cardano (ADA), Solana (SOL) and Chainlink (LINK) were the hardest hit, among cryptocurrencies ranked in the top 30 by market capitalization.

At the time of writing, while most altcoins remain 60 to 90% below their all-time highs, Dogecoin and XRP hold on to their double-digit gains from six months ago. Ethereum (ETH) is one of the hardest hit, even though the altcoin was declared a commodity and found a place in the U.S. crypto stockpile.

The crypto Fear & Greed Index shows traders remain fearful, though less so, relative to last week and last month. The indicator reads 44 on a scale of 0 to 100, as seen in the chart below.

Memecoins, being highly speculative compared to the rest of the categories in crypto, they typically exhibit a stronger reaction from traders during price swings and phases of uncertainty and volatility.

While memes carry higher-risk and higher-reward opportunities for traders, macroeconomic developments, tariff announcements and geopolitical tensions have typically weighed negatively on the sector, wiping out gains and driving capital outflow as traders turn risk-off.

Lark Davis, a Bitcoin proponent and crypto analyst believes news of tariffs could lay the biggest bear trap in crypto, meaning more pain for altcoin holders before signs of recovery.

Sentiment among traders plays a key role in altcoin recovery, since meme coins and low market cap tokens have larger retail participation as opposed to institutional capital flows.

How crypto traders can prepare for tariff announcements

With Liberation day (April 2) five days away, crypto traders prepare for a softening in activity. Bitcoin could test resistance at the $88,000 level, that acted as support in the short-term. Dovish stance of the US Federal Reserve and indications that Trump is opting for a “benign” tariff strategy could support the sentiment among traders, according to a K33 research report published on March 25.

With a streak of positive ETF netflows to Bitcoin and Ethereum in a state of decline, it is safe to assume that altcoins could be the hardest hit, in response to market-moving announcements. Overall activity in the derivatives market remains low, leverage is soft and yields are muted.

Crypto traders should take a risk-off approach instead of adding to derivatives positions ahead of the Liberation Day, considered a momentous day by analysts. It is expected that April 2 will shape the crypto market’s volatility as traders digest tariff announcements and the reaction of international markets.

Ethereum is the worst hit, due to prominent role in DeFi

While Ethereum is the largest altcoin, ETH has been declared “dead” and a “zombie token” by analysts at different points during this market cycle. Given that Ethereum is the underlying blockchain for the entire DeFi ecosystem, constituting of Layer 2 and Layer 3 protocols, Ether suffers a more significant impact than the rest of the altcoins.

Zack Shapiro, head of policy at the Bitcoin Policy Institute believes that Ethereum has faced the worst sell-off during downturns in the crypto market as DeFi relies more on automation for trading. It is likely that leverage results in sharp declines in ETH price, and drives large-volume sell-offs, profit-taking and loss realization by whales and large entities.

When highly leveraged institutional players’ positions are liquidated it has a steep negative impact on Ether price, and the altcoin is the worst hit.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Leave feedback about this