XRP’s derivatives market has experienced a structural shift as leveraged positions continue to decline across major cryptocurrency exchanges, according to market data.

Summary

- XRP’s derivatives market has seen a sharp decline in open interest, falling to $902 million, its lowest level since 2024, as leveraged positions unwind across major exchanges like Binance.

- The reduction in leverage, which previously amplified price movements, signals a “clean-up” phase in the market, typically resulting in reduced price volatility and potential consolidation or price base formation.

- Analysts suggest two potential outcomes: a balanced market structure if open interest stays low and prices stabilize, or the beginning of a new trend if open interest rebounds alongside price momentum.

Open interest across all exchanges has fallen to approximately 902 million, its lowest level since 2024, according to a new report citing CryptoQuant. The figure represents a substantial reduction from 2025 highs, when open interest consistently exceeded 2.5 billion to 3 billion.

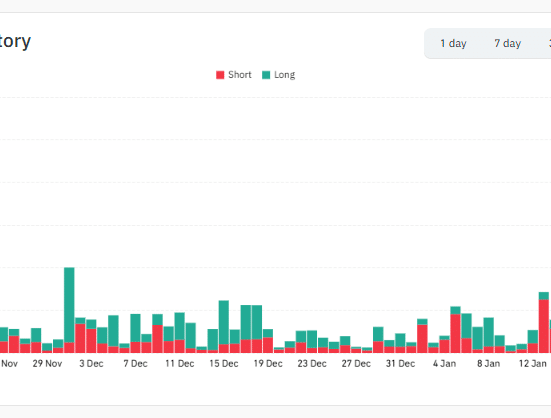

On Binance, open interest in XRP contracts has declined to around 458 million. The simultaneous decline across multiple platforms indicates leverage is being removed from the system broadly rather than shifting between exchanges, according to market observers.

The contraction occurs while XRP’s price has remained relatively stable compared with earlier peaks, positioning data shows. The reduction in leveraged exposure marks a contrast with 2025 conditions, when leverage expansion played a larger role in price movements.

Market analysts note that such contractions typically reflect a leverage cleanup phase, where speculative positioning is reduced. These conditions often coincide with reduced price volatility, as fewer leveraged positions remain to amplify short-term price movements.

Historically, environments characterized by falling open interest have preceded either extended consolidation phases or the formation of new price bases, rather than immediate directional price expansion, according to market data.

Two potential scenarios exist for the market’s next phase. If open interest remains suppressed while price stabilizes, the market may be absorbing the leverage reset and transitioning into a more balanced structure. Alternatively, any future rebound in open interest, particularly if accompanied by improving price momentum, could signal that a new trend is beginning to form.

The current environment represents a structural reset in the XRP derivatives market, with future direction dependent on whether leverage returns alongside renewed price momentum, analysts said.

Leave feedback about this