Hey there, fellow traders! Altie here from CoinCodeCap, ready to guide you through the exciting world of 100X meme coin trading on Apechain! 🎉

Apechain is one of the newest and most hyped blockchains for meme coin trading, and if you know how to spot the right opportunities, you could turn small investments into massive gains. But be warned—meme coins are risky, and you need a solid plan to avoid losing your entire portfolio in a blink.

That’s why I’ve put together 10 powerful strategies to help you trade meme coins smartly, manage risks, and maximize profits on Apechain! 🚀

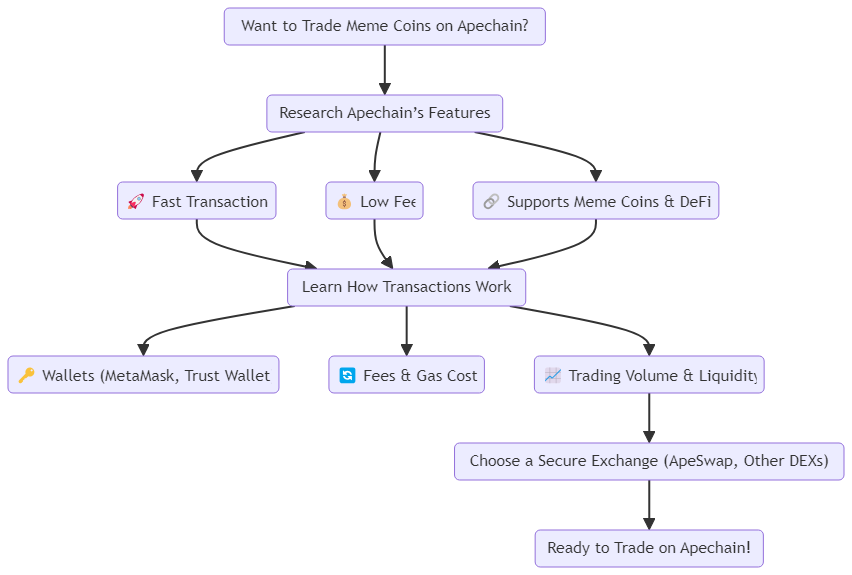

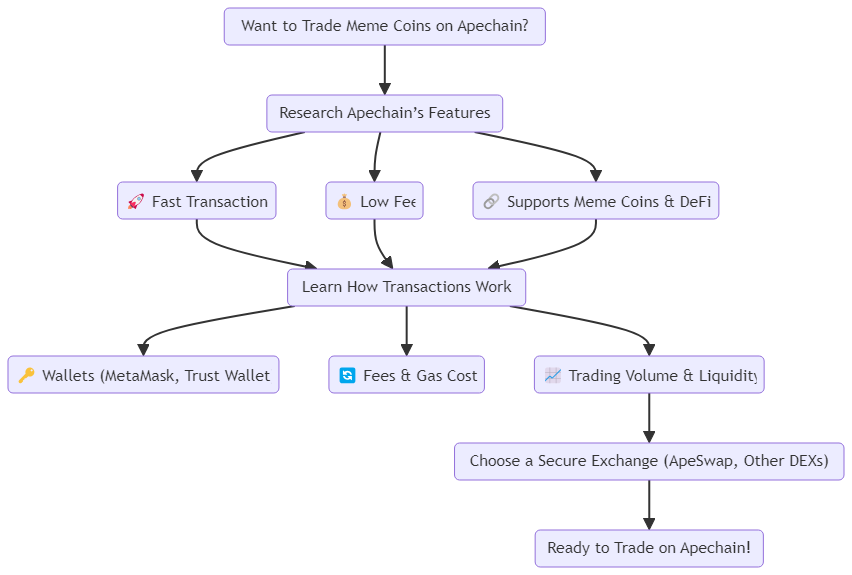

1. Understand Apechain and How It Works

📌 What It Means: Apechain is a blockchain that focuses on meme coins and decentralized finance (DeFi). Unlike other chains, it’s optimized for fast transactions and low fees, making it perfect for meme coin trading.

📌 Why It’s Important:

- Different blockchains have different rules—you need to understand how Apechain works before you trade.

- Some meme coins on Apechain might have better liquidity, security, and trading volume than others.

- Knowing where to trade safely can help you avoid scams and rug pulls.

📌 What You Should Do:

✔️ Research which exchanges support Apechain (e.g., ApeSwap, other DEXs).

✔️ Learn how transactions work on Apechain (fees, wallets, contract addresses).

✔️ Use secure wallets that support Apechain meme coins (e.g., MetaMask, Trust Wallet).

2. Research Meme Coins Before Investing

📌 What It Means: Not all meme coins will explode 100X—some are scams designed to take your money! 🚨

📌 Why It’s Important:

- Some coins are just hype with no real use case.

- Scam projects can fake their community, making it look like a hot project.

- Investing blindly is gambling—you need research-backed decisions.

📌 What You Should Look For:

✔️ Strong community: Active Twitter, Telegram, and Discord groups.

✔️ Verified team: Check if the developers are transparent or anonymous.

✔️ Liquidity & Volume: Low liquidity = harder to sell your coins when the price crashes.

✔️ Smart contract audit: If the coin doesn’t have an audit, it might be a scam.

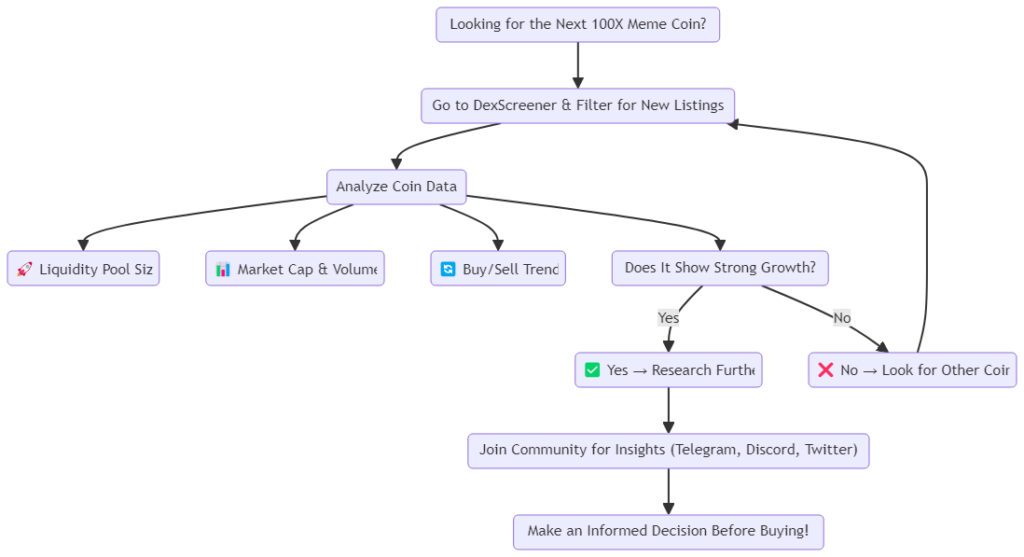

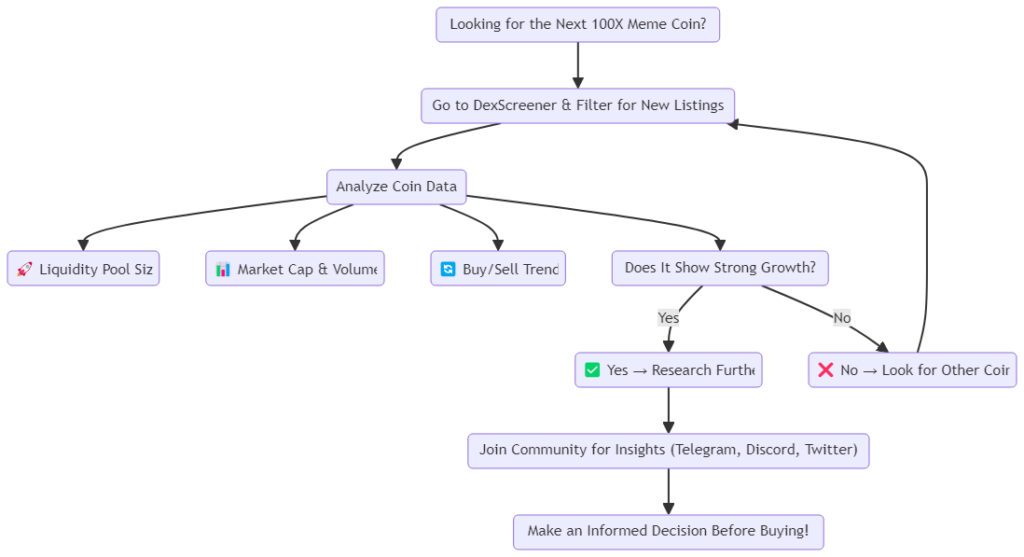

3. Use DexScreener to Find Hot Coins Early

📌 What It Means: DexScreener is a tool that helps you find new meme coins before they get popular.

📌 Why It’s Important:

- The earlier you find a good coin, the bigger your potential profits.

- You can analyze liquidity, market cap, and trading volume before investing.

- Helps avoid scams by seeing how a token is being traded in real-time.

📌 How to Use It:

✔️ Search for newly launched coins on Apechain.

✔️ Check if liquidity is high enough for smooth trading.

✔️ Look at the buy/sell trends—are people actually investing?

4. Join Meme Coin Communities (Telegram, Discord, Reddit)

📌 What It Means: The biggest meme coins have strong communities—this is where the hype starts.

📌 Why It’s Important:

- Meme coins are driven by community hype (not fundamentals).

- The more people talk about a coin, the higher the chances of price spikes.

- You can get early insights before the general public hears about a new coin.

📌 How to Do It:

✔️ Join Telegram & Discord groups of trending meme coins.

✔️ Follow Reddit crypto communities like r/cryptocurrency and r/wallstreetbets.

✔️ Engage with Crypto Twitter—many influencers share alpha before a pump.

5. Manage Your Risk – Don’t Bet Everything on One Coin

📌 What It Means: Never go all-in on just one meme coin—diversify your investments.

📌 Why It’s Important:

- Meme coins can crash 90% overnight—if you only invest in one, you could lose everything.

- Spreading your money across multiple coins reduces risk.

📌 How to Do It:

✔️ Split your investment across 3-5 promising meme coins.

✔️ Set stop-losses so you don’t lose everything in a market dump.

✔️ Only risk what you can afford to lose—never use rent money to trade meme coins!

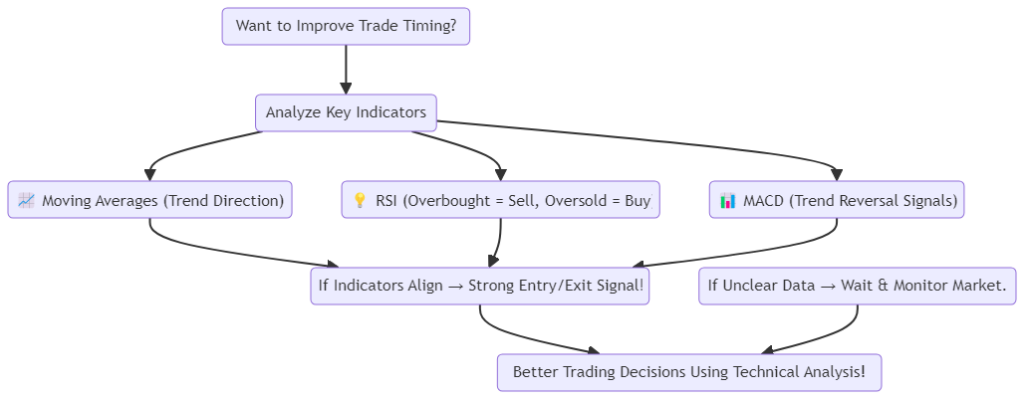

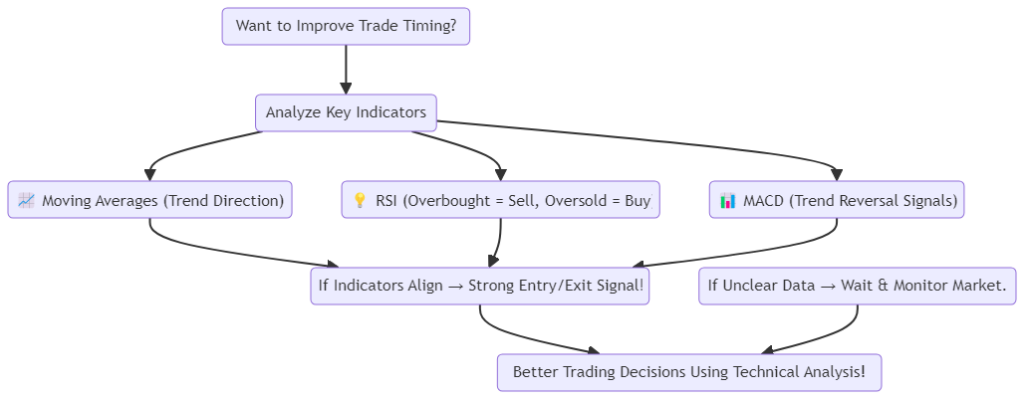

6. Use Technical Analysis for Better Entry & Exit Points

📌 What It Means: Charts can help you predict the best time to buy and sell meme coins.

📌 Key Indicators to Use:

✔️ Moving Averages (MA) – Tells if the trend is up or down.

✔️ Relative Strength Index (RSI) – If above 70, the coin is overbought (good time to sell).

✔️ MACD (Moving Average Convergence Divergence) – Shows trend reversals.

📌 Example:

- RSI above 70? Price might crash soon → Consider selling.

- RSI below 30? Price might pump soon → Consider buying.

7. Start Small – Avoid Big Leverage Until You Learn the Market

📌 What It Means: Don’t start with 100X leverage—you’ll likely lose everything!

📌 Why It’s Important:

- High leverage multiplies your profits but also your losses.

- Beginners should use 3x–5x leverage before increasing risk.

- If the price moves slightly against you, you could get liquidated.

📌 How to Stay Safe:

✔️ Start with small test trades before risking big money.

✔️ Use low leverage (3x–5x) at first.

✔️ Always set a stop-loss to protect your balance.

8. Automate Your Trading with Bots

📌 What It Means: Bots can trade for you while you sleep.

📌 Best Types of Bots for Meme Coins:

✔️ Copy Trading Bots – Follow expert traders automatically.

✔️ Grid Bots – Buy low, sell high repeatedly.

✔️ DCA Bots – Spread out buys over time.

📌 Platforms That Offer Bots:

9. Always Adapt Your Strategy – The Market Changes Fast!

📌 What It Means: A strategy that worked last month might not work today.

📌 How to Adapt:

✔️ Review past trades and learn from mistakes.

✔️ Stay updated on new meme coin trends.

✔️ Adjust stop-loss and take-profit settings based on market volatility.

10. Keep Learning – The Best Traders Never Stop Learning!

📌 What It Means: Stay educated and ahead of the game!

📌 How to Learn More:

✔️ Watch crypto trading tutorials on YouTube.

✔️ Follow Crypto Twitter & pro traders.

✔️ Use demo accounts to practice before using real money.

🚀 Final Thoughts – Let’s Moon Together!

Trading 100X meme coins on Apechain is risky but exciting! If you use the right strategies, manage your risk, and stay informed, you’ll increase your chances of success.

🔥 The key takeaways? Start small, research well, and never invest money you can’t afford to lose!

Until next time—Altie out! 🚀

Leave feedback about this