Before MicroStrategy began buying Bitcoin in November 2020, it was unheard of for a public company to stack up “risky” cryptos. True, some of the best cryptos to buy have had more than 100X since their launch. However, the lack of clear regulations was a massive obstacle.

This rapidly changed after Michael Saylor went all-in on Bitcoin, buying billions worth of BTC. In January 2026, Strategy sold shares and bought over $3Bn of Bitcoin. Not to be left behind, Metaplanet is also executing its own plan to raise funds and buy Bitcoin.

第三者割当による新株式及び第 25 回新株予約権の発行に関するお知らせ pic.twitter.com/YPhua9p7d3

— Metaplanet Inc. (@Metaplanet) January 29, 2026

All this is happening just when the Bitcoin price is stuck below $90,000, with hopes fading that the BTC USD price will break $100,000 in the next two weeks. Sentiment remains bearish, but looking at the fundamentals, there could be a chance for buyers to show their hand.

Crypto Fear and Greed Chart

1y

1m

1w

24h

DISCOVER: Best New Cryptocurrencies to Invest in 2026

Metaplanet Plans To Buy $137M Worth of Bitcoin

Earlier today, Japan-listed Metaplanet approved a plan to raise up to $137M from overseas investors to buy more Bitcoin and repay debt. Interestingly, even after this news was made public, the Metaplanet stock barely flinched after the filing, a sign that markets already expect aggressive Bitcoin accumulation from the firm. If anything, it shows that the market supports Metaplanet’s shift from a hotel operator to a “Bitcoin Treasury Company.”

Metaplanet will sell new shares and warrants to foreign investors. Specifically, the raise is split into two main parts to maximize capital while managing the dilution of current shareholders. They are issuing 24.5 million new common shares at roughly $3 per share, aiming to raise roughly $78M immediately.

Metaplanet has closed its first institutional shares + warrants transaction to accelerate our Bitcoin strategy. Total proceeds of up to ¥21B, comprising ¥12.2B in shares issued at a 5% premium (¥499) and up to ¥8.8B from 1-year warrants issued at a 15% premium (¥547 exercise… pic.twitter.com/OprgedN4Fd

— Simon Gerovich (@gerovich) January 29, 2026

Shareholders also approved the issuance of 159,440 warrants, giving investors the right to buy more shares later at a fixed price. If all are exercised within the next year, it could bring in another $56M.

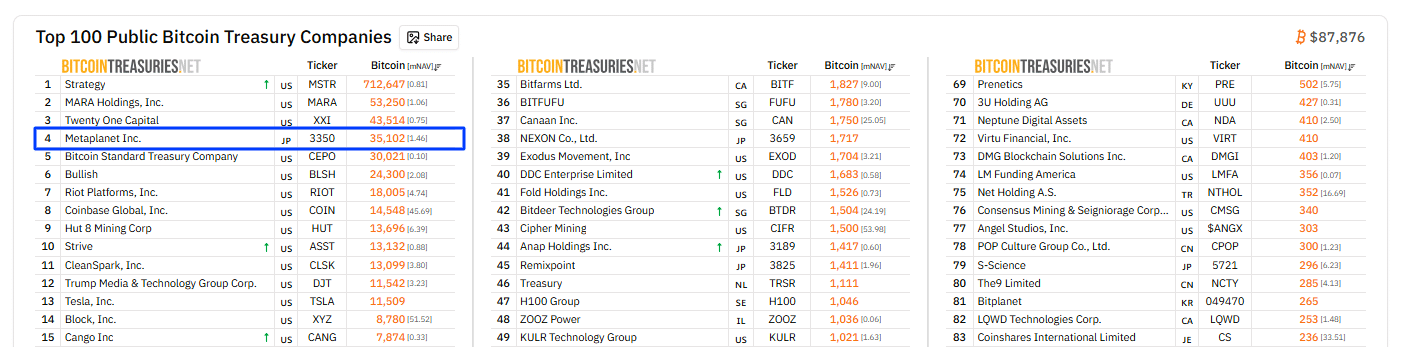

It should be noted that Metaplanet has been very transparent about its Bitcoin buying plan. Out of the $137M, a big chunk will be allocated to buying Bitcoin. When they do, it will cement their position as one of the largest corporate holders globally.

(Source: Bitcoin Treasuries)

Another portion of the raised amount will be used to pay down existing loans. Logically, clearing debt allows them to reload their credit facilities. In turn, this will give them more flexibility to borrow again if the Bitcoin price dips.

However, unlike MicroStrategy, Metaplanet will be putting its BTC to work. For example, they are investing in their “Bitcoin Income” segment. This division uses derivatives, like selling put options, to generate yield on its existing holdings.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

Is This A New Playbook for Corporate Bitcoin Treasuries

Metaplanet calls itself a “Bitcoin Treasury Company.” That means Bitcoin sits at the center of its strategy, not as a side experiment. This mirrors the playbook used by MicroStrategy and discussed in our guide to corporate crypto treasuries. However, they are changing the game when it comes to raising funds.

The company already holds tens of thousands of BTC worth billions of dollars. By targeting foreign investors primarily through private placements, Metaplanet is tapping into a deeper pool of capital than what is typically available to small-cap firms on the Tokyo Stock Exchange. That flexibility matters when you want to buy Bitcoin during price dips.

The motivation is simple: Metaplanet is capitalizing on the high volatility of its own stock. Because the stock often trades at a “premium” to the actual value of the Bitcoin the company owns, they can sell expensive shares to buy “cheap” Bitcoin. This is a play straight out of MicroStrategy’s playbook.

Furthermore, the diversification away from the Yen means MetaPlanet is now, more than ever, focused on the BTC Yield, which is simply a measure of the amount of BTC held per share. Even though shares will be diluted after the $137M raise, the BTC Yield will rise since they will own more BTC.

METAPLANET MOON MATH

Metaplanet had a 568.2% BTC Yield last year.

Their small size helped.

Even assuming they never trade at a huge multiple, and assuming a much lower BTC Yield, the returns are still ridiculous over the next 5 years.

1× mNAV returns with a 75 % BTC… pic.twitter.com/92zLtbA9rz

— Adam Livingston (@AdamBLiv) January 5, 2026

Overall, this is a bullish sign for Bitcoin. When public firms raise real money to buy Bitcoin, it reinforces the idea that institutions view BTC as a long-term hedge, not a quick flip. Corporate buying tightens supply. Bitcoin has a fixed cap, so when companies lock it away on balance sheets, fewer coins trade freely. That supply squeeze often supports higher prices over time.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Metaplanet Plans $137M Bitcoin Buy Using Overseas Stock Deal appeared first on 99Bitcoins.

Leave feedback about this