Weekly Roundup: Is XRP a Good Investment, Why Is Zcash Failing?

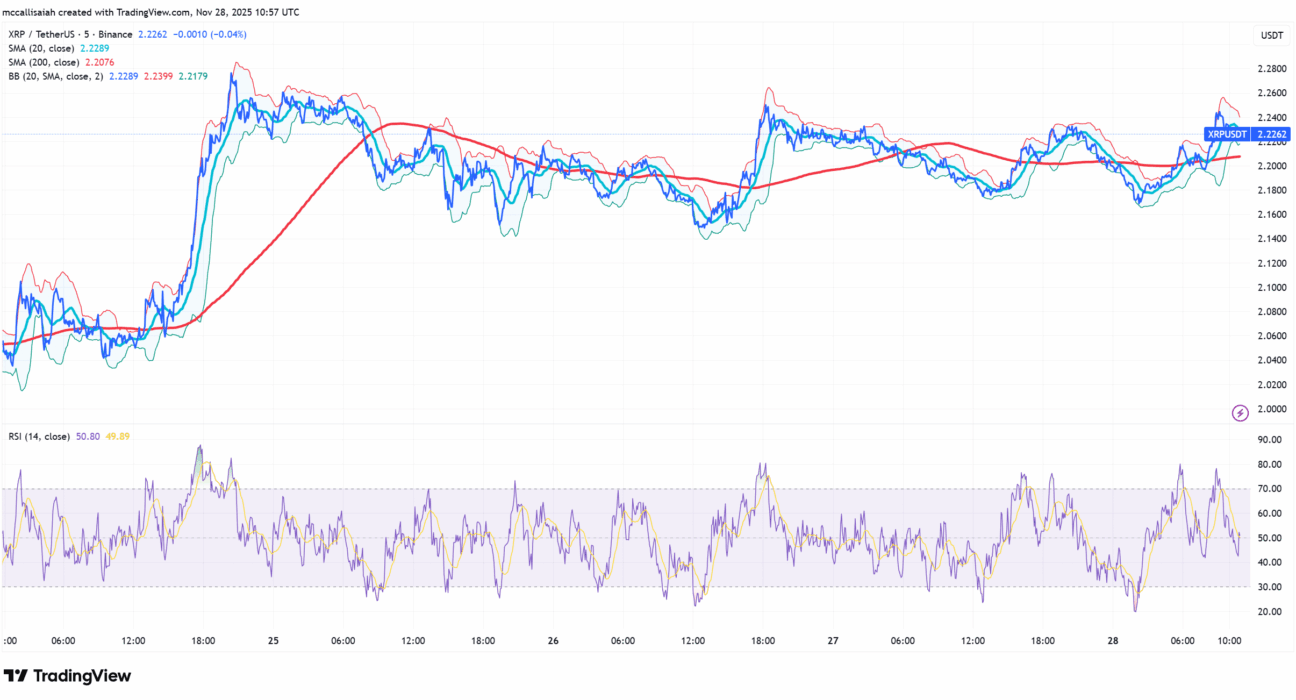

Welcome to another weekly roundup from 99Bitcoins, sponsored by Michael Saylor (or at least trying!), where we’ll discuss if XRP is a good investment, and why Zcash is falling. As it stands, XRP is struggling with overhead resistance, while ZEC continues to sink deeper into bearish territory. Wider macro signals, Fed rate bets, equity rotation, and cooling energy