31 Jan AI, Repricing Risk and the Outlook for Bitcoin in 2026

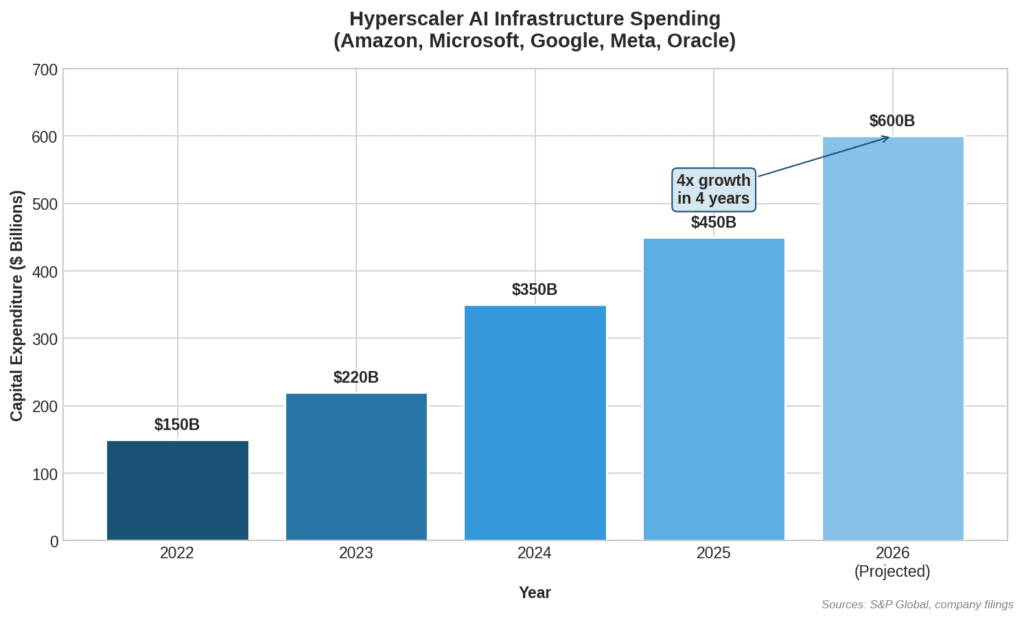

Artificial intelligence has become the dominant narrative in global markets over the past 18 months. What began as a major technological breakthrough has evolved into a once-in-a-generation capital-allocation story, with investment now running into the hundreds of billions across data centres, advanced semiconductors and the power infrastructure required to support them.

That scale naturally raises a familiar question for markets: is this a sustainable investment cycle, or have expectations around AI moved ahead of what near-term outcomes can realistically deliver?

The answer matters for Bitcoin, not because AI fundamentally changes Bitcoin itself, but because dominant narratives shape how investors price risk, allocate capital and rebalance portfolios.

Whether AI optimism ultimately unwinds or holds will have important implications for how Bitcoin and crypto markets behave throughout the rest of the year.

Bitcoin and the Repricing of Risk

Despite its distinct monetary properties, Bitcoin continues to be treated as part of the same risk-rebalancing assessments that dictate flows across global equity markets.

When investors reassess exposure to growth-heavy, capital-intensive themes, Bitcoin often moves in the same direction — not as a judgement on Bitcoin itself, but as part of broader portfolio rebalancing driven by liquidity and risk management.

Recent market action provides a clear reference of this dynamic, with Bitcoin moving alongside broader risk assets as investors adjusted exposure elsewhere.

Paolo Ardoino, Bitfinex CTO and CEO of Tether, addressed this tendency in a recent episode of Bitcoin Capital, noting that a sharp reversal in AI sentiment this year could spill into US equities and pull Bitcoin down in the near term. At the same time, he argued that Bitcoin’s market structure today is meaningfully different from prior cycles, with deeper institutional participation beginning to provide a more durable base of demand.

What “Repricing Risk” Actually Looks Like

Markets do not require technologies to fail for prices to reset, just that the gap between expectations and outcomes grows excessively over time.

Periods of exuberance around new technological innovations tend to follow a familiar pattern.

Capital concentrates, tolerance for uncertainty rises and investors become more open to holding multiple high-volatility exposures at the same time. When confidence wanes, that tolerance contracts quickly. Liquidity thins, leverage is reduced and correlations rise.

The dot-com unwind remains the clearest recent example. The internet ultimately reshaped the global economy, yet between 2000 and 2002 the entire Nasdaq fell by nearly 80%.

The long-term thesis was correct. The near-term pricing was not.

There are echoes of that dynamic today with AI. Despite enormous and growing investment in AI infrastructure, evidence of near-term monetisation remains uneven.

A recent Bain & Company report suggests that supporting the implied AI infrastructure build-out would require roughly $2 trillion in annual revenue by the end of the decade. Even under generous assumptions, Bain estimates revenues may fall around $800 billion short.

That gap between investment and realised returns does not invalidate the technology’s long-term prospects, but it has left markets increasingly sensitive to delays, margin pressure or revised guidance.

Why Bitcoin Leads During Risk Repricing

Bitcoin’s response during periods of risk repricing is primarily a function of liquidity.

Bitcoin trades continuously in deep, global markets. Over time, that liquidity is a strength. In moments of stress, it also makes Bitcoin a quick and efficient source of risk reduction. Unlike gold, Bitcoin does not yet benefit from universal recognition as a safe-haven asset. Instead, it remains widely held within discretionary portfolios that are actively rebalanced as conditions change.

Even gold, however, experienced sharp downward moves during the most recent market volatility, reinforcing the idea that the repricing was driven by liquidity and portfolio rebalancing rather than anything inherently related to Bitcoin.

That helps explain why Bitcoin moved alongside equities this week despite the absence of any Bitcoin-specific catalyst. This latest move is a reflection of how Bitcoin is currently used, not a reassessment of its underlying properties.

That context sets the stage for how Bitcoin would likely behave if AI optimism were to experience a major reversal.

If AI is a Bubble: Implications for Bitcoin into 2026

If AI investment proves to be meaningfully ahead of sustainable returns, the immediate impact would unlikely be confined to technology stocks alone. A broader repricing of growth expectations would tighten liquidity, reduce leverage and pressure risk assets across the board.

In that environment, Bitcoin would likely remain volatile in the short term. As one of the most liquid global risk assets, it would continue to be used as a source of risk reduction during periods of stress. Further drawdowns in such a scenario would not reflect a failure of Bitcoin’s fundamentals, but its role within portfolio construction.

Where this cycle differs is what happens after the initial repricing. Institutional ownership, regulated investment vehicles such as spot ETFs and longer-duration allocations now anchor a growing share of Bitcoin supply.

Capital rotates rather than disappears when a dominant narrative unwinds. As confidence in long-duration, infrastructure-heavy stories weakens, attention historically shifts toward assets that are liquid, globally accessible and seen as undervalued.

Into 2026, this dynamic suggests a Bitcoin market characterised less by prolonged capitulation and more by volatility followed by consolidation and recovery. As Paolo notes, drawdowns would remain possible, but the extreme, multi-year 70–80% declines that defined earlier cycles appear less structurally embedded than before.

If AI is Not a Bubble: Where We Are in the Cycle

If AI ultimately delivers on its long-term promise, the current phase still matters. Today’s market reflects an infrastructure-heavy build-out stage, where capital expenditure is front-loaded and monetisation lags deployment.

Here, volatility in AI-linked equities would be less about collapse and more about timing. Returns would simply take longer to materialise than markets had assumed.

A strong and durable AI narrative could also crowd out other high-volatility investments, including Bitcoin, not through collapse but by offering a more visible path for investors to enjoy returns. In such an environment, Bitcoin may trade sideways or grind higher rather than experience sharp repricing in either direction.

That outcome would be consistent with Bitcoin continuing its transition toward a more macro-oriented allocation, absorbing capital incrementally and responding primarily to changes in liquidity rather than to any single dominant narrative. Correlations with risk assets would persist, but against a backdrop of improving market depth, ownership and more stable capital.

What This Means for Bitcoin into 2026

Whether AI optimism ultimately unwinds or endures in 2026, Bitcoin enters the year with a different market structure than in previous cycles.

While it remains sensitive to shifts in investor confidence, it now does so against a backdrop of deeper liquidity, broader ownership and more established institutional infrastructure than in prior periods.

In that sense, the significance of any repricing event, including a large-scale reversal in AI sentiment, lies less in any immediate price action. What will be more important is what such moments reveal about Bitcoin’s ongoing transition from a high-volatility outlier toward an increasingly familiar, if still imperfect, component of the global financial system.