Traders have long sought the optimal time to trade crypto, and at different points over the years, European, US, and Asian time zones have all had their turn, offering the best returns. However, a newly proposed ETF now offers Bitcoin exposure with a twist.

The Nicholas Bitcoin and Treasuries AfterDark ETF aims to trade Bitcoin-linked assets while Wall Street sleeps. According to a December 9 filing with the SEC, the AfterDark ETF plans to purchase BTC after US financial markets close and exit those positions shortly after the US market reopens each day.

Bitcoin is trading at $90,090 at the time of writing, down 2.1% on the day after a period of volatility that began with yesterday’s FOMC meeting, in which the US Fed cut interest rates by 25 bps. Once the dust settles, BTC will need to hold above $90,000 and reclaim $96,00 for any hopes of climbing back above $100,000 before the year is out.

Has the AfterDark ETF Found an Infinite Money Glitch With Bitcoin Trading?

The Nicholas Bitcoin and Treasuries fund would not hold Bitcoin directly. Instead, the AfterDark ETF would allocate at least 80% of its assets to trading BTC futures contracts, BTC ETPs and ETFs, and options on those ETFs and ETPs.

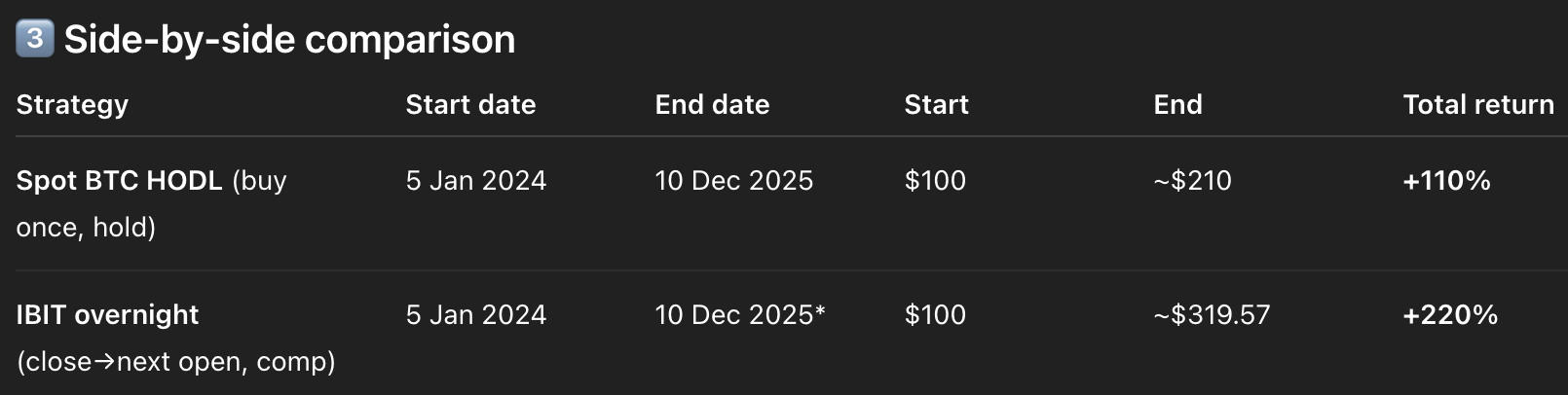

Data from wealth manager Bespoke Investment Group show that an investor who bought shares of the BlackRock iShares Bitcoin Trust ETF (IBIT) at the US market close and sold them at the next day’s open would be up about +222% since January 2024.

On the flip side, an investor who bought those same IBIT shares at the open and sold them at the close would be down -40.5% over the same period. This data supports the long-held belief that trading crypto during Asian hours is the most profitable time zone.

A NEW ETF BUYING $BTC AT NIGHT IS COMING!

Unlike normal ETFs, AfterDark ETF holds BTC only at night, buying when U.S. market closes and selling before they open.

Eric Balchunas says most BTC gains happen after hours, so this ETF could show "better returns." Launch in 75 days. pic.twitter.com/Ipg9DaHZAP

— Coin Bureau (@coinbureau) December 10, 2025

ChatGPT supports these claims and, when run on the dataset, produces results identical to those from the Bespoke Investment Group data. Going one step further, this strategy outperformed buying and holding $100 worth of Bitcoin over the same period. Holding spot BTC would have resulted in $100 becoming $210 by December 10, 2025, for a 110% return.

This means that the AfterDark ETF strategy of buying IBIT shares at the NY market close and selling at the subsequent NY market open would have outperformed the ‘spot and chill’ play by more than +100%.

The AfterDark ETF is scheduled to go live in approximately 75 days, in mid-February 2026. While a larger dataset is needed, with 23 months of data, this strategy of buying BTC or Bitcoin-linked TradFi products, such as the iShares ETF, appears to be a free-money glitch that avoids the most significant periods of market volatility.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

ChatGPT Confirms Asian Trading Hours are Prime for Stable Bitcoin Price Action

When asking ChatGPT to analyze different trading sessions for crypto, it broke it down as follows;

“US Trading Hours (13:00–20:00 UTC) – Highest trading volume globally, often the most volatility with more opportunity and more risk. Many major announcements from U.S. companies and regulators occur here.

Common view: “Best for volatility-based strategies.”

European Session (07:00–16:00 UTC) – Strong liquidity, often begins daily momentum before US session ramps up.

Common view: “Best for trend traders, fewer price shocks than U.S. hours.”

Asia Session (23:00–06:00 UTC) – Liquidity varies. Historically lower volatility (but changes depending on Japan/Korea activity and China-related news)

Common view: “Best for range trading and low-noise setups.”

This ChatGPT breakdown of trading time zones emphasizes that Asian hours are ideal for trading strategies such as the AfterDark ETF, as lower liquidity and lower volatility enable steadier gains by buying at the NY close and selling at the following NY open.

If the strategy remains profitable over the next 75 days leading up to the Bitcoin

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

2.49%

Bitcoin

BTC

Price

$90,696.41

2.49% /24h

Volume in 24h

$46.43B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

AfterDark ETF launch, it is likely to become an extremely popular investment product. It may even spawn other variations that utilize other profitable strategies.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post AfterDark ETF Solves Bitcoin’s Timezone Puzzle: Counter-Trade Americans To Unlock Hidden 222% Return Trend appeared first on 99Bitcoins.

Leave feedback about this