Scammers used a fake DBS crypto trading app and WhatsApp group to steal over $130,000 from a retired engineer, prompting cybercrime warnings from authorities.

Summary

- Retired engineer in Miyapur lost about Rs 1.28 crore via a fake DBS crypto trading app promoted in a WhatsApp group.

- Scammers built trust with a small successful withdrawal before demanding a 20% fee and blocking the victim’s account.

- Cybercrime police urge investors to verify platforms, ignore guaranteed-return pitches, and report suspicious activity quickly.

Authorities have issued warnings about fraudulent crypto trading investment schemes following an incident in which a retired engineer lost approximately $130,000 to scammers operating through WhatsApp groups and fake applications, according to police reports.

A 65-year-old retired engineer from Miyapur lost 1.28 crore rupees to fraudsters running a counterfeit online trading operation, Cyberabad cybercrime police reported. The victim, formerly employed at a government enterprise, filed a complaint with authorities on Friday.

Scams using fake crypto trading apps

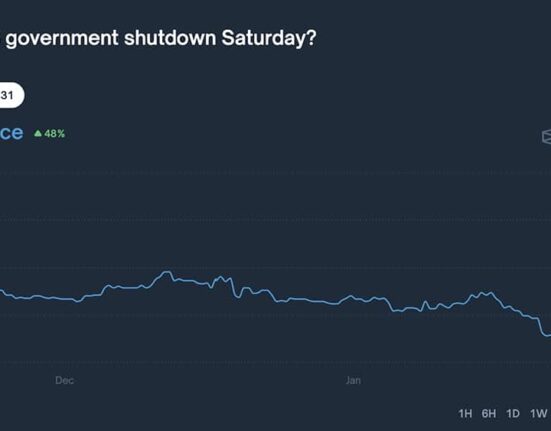

According to the police account, scammers added the victim to a WhatsApp group called “531 DBS Stock Profit Growth Wealth Group” on November 4. The group was administered by an individual identifying as Professor Rajat Verma, with another participant named Meena Bhatt acting as an analyst. The operators persuaded the victim to install a mobile application called DBS, developed under the domain name ggtkss.cc.

The fraudsters offered the victim exclusive access to block trades and high-quality initial public offering allocations, presenting these as opportunities unavailable to regular investors, police stated. The victim made an initial investment of Rs 1 lakh on November 4. The operators permitted a withdrawal of Rs 5,000, which established trust and encouraged additional investments.

Between November 4 and December 5, the victim made multiple transfers totaling more than 1.2 crore rupees through various bank accounts and Unified Payments Interface transactions, according to the complaint. The investments included subscriptions to the Capital Small Finance Bank IPO and participation in a share repurchase program.

When the victim attempted to withdraw his accumulated balance, the operators demanded a 20 percent fee before permanently blocking access to his account, police reported. The victim subsequently filed a complaint with Cyberabad cybercrime police.

Authorities registered a case under Sections 318(4), 319(2), 336(3), 338 and 340(2) of the Bharatiya Nyaya Sanhita, read with Section 3(5), and Section 66-D of the Information Technology Act.

Cybercrime experts have advised investors to verify platforms and confirm regulatory approvals before making investments. Authorities noted that fraudulent credentials and guaranteed return promises are common tactics used by scammers, and urged victims to report suspicious activity to cybercrime authorities immediately.

Leave feedback about this