U.S. shares are down because the lethal Israeli strike in opposition to Iran ignites fears of a regional struggle within the Center East.

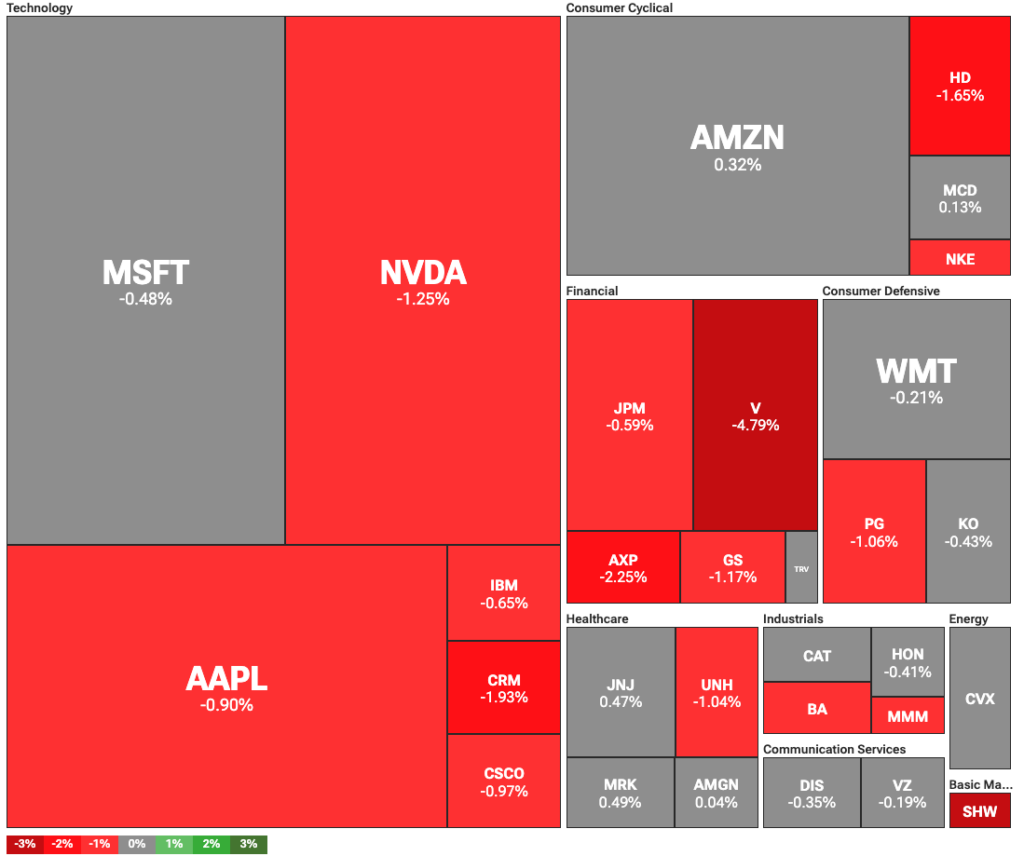

Main U.S. inventory indices fell Friday, June 13, as fears of a regional struggle fueled risk-off sentiment. The Dow Jones Industrial Common dropped 525.80 factors, or 1.22%, with practically all main shares buying and selling within the purple. The S&P 500 slipped 0.54%, whereas the tech-heavy Nasdaq was down 100 factors, or 0.53%.

Markets are rattled by the potential financial fallout of escalating tensions between Israel and Iran. Israel carried out a sequence of lethal assaults on Iranian army and nuclear services. The Israeli authorities claimed Iran’s nuclear program poses an existential risk, whereas Iran vowed to ship a “authentic and highly effective response.”

Altcoins hit laborious by world tensions

The escalating battle is inflicting merchants to rethink publicity to high-growth and high-risk property like tech shares. Notably, Nvidia fell 1.5%, and Apple declined 1% following the assaults. Concurrently, traders rotated into conventional secure havens corresponding to gold and the greenback.

Consequently, crypto was among the many most affected asset courses by Center East tensions. The general crypto market cap was down 2.7%, whereas Bitcoin (BTC) was down 2.19%, falling to $105k. Main altcoins like Ethereum (ETH) and Solana (SOL) have been hit even tougher, dropping 7.1% and seven.45% respectively.

Fears of a struggle between Iran and Israel contributed to surging oil costs. Crude oil was up 14% at one level, to a excessive of $79 per barrel. Iran sits on the Persian Gulf, a important area for world oil manufacturing, near among the world’s largest oil producers.

Rising oil costs are additionally fueling renewed inflation fears. This comes at a time when U.S. tariffs on main buying and selling companions are anticipated so as to add extra inflationary stress. The rising uncertainty could scale back the chance of rate of interest cuts by the Federal Reserve, a damaging sign for each tech and crypto markets.