XRP worth may very well be on the cusp of a powerful bullish breakout within the coming days after forming a bullish chart sample and as whales proceed accumulating.

Ripple (XRP) continued to consolidate on Friday, buying and selling at $2.216, up by 36% from its lowest stage in April. A possible catalyst for XRP worth is the continued accumulation by whales over the previous few months.

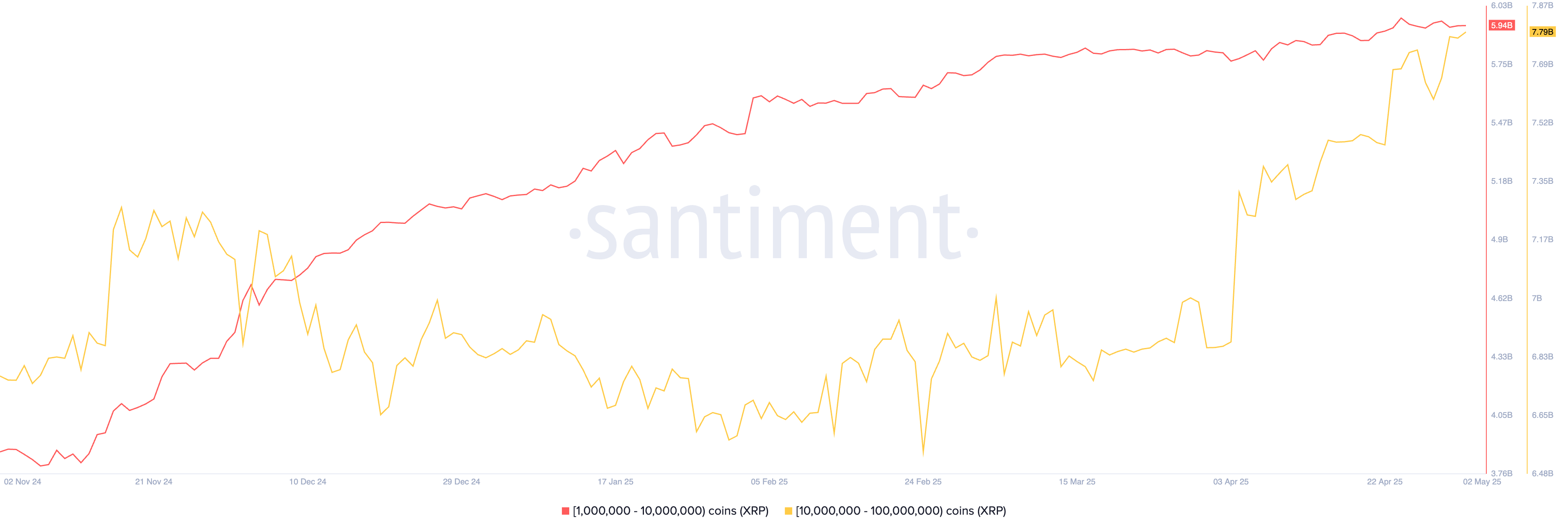

Santiment information exhibits that wallets holding between 1 million and 10 million cash have elevated their holdings from 3.8 billion in November final yr to five.9 billion immediately, a acquire of two.1 billion.

Equally, the cohort holding between 10 million and 100 million cash has elevated their complete from 6.5 billion in February to 7.9 billion. These figures counsel that large-scale traders, usually seen as extra subtle than retail merchants, imagine XRP has extra upside forward.

Ripple worth has quite a few catalysts

The continuing XRP shopping for frenzy is basically pushed by investor optimism surrounding a number of key catalysts.

One main issue is the anticipated approval of an XRP ETF by the Securities and Alternate Fee, which analysts imagine may herald over $8 billion in inflows inside the first yr. Whereas the official deadline is in October, expectations are that the SEC may approve it as early as June. Consequently, traders see shopping for XRP now as an opportunity to front-run this growth.

Additional, analysts are extremely bullish on the XRP, with Customary Chartered predicting that it might rise 6x from right here. Such a transfer would push its market cap to over $600 billion, overtaking Ethereum (ETH) if its worth continues to underperform.

XRP worth might profit from its rising market share within the stablecoin market. Its Ripple USD (RLUSD) has gained a market cap of over $330 million. Visa expects that the stablecoin market shall be price $1.6 trillion by 2030. If RLUSD gained a 5% market share, its belongings would quantity to over $80 billion.

Different catalysts are its objectives to disrupt the Swift cost system, the current acquisition of Hidden Road, and the potential Circle buyout.

XRP worth technical evaluation

The day by day chart exhibits XRP has held regular in current periods. This era of consolidation comes after a breakout above a descending trendline connecting the best swing factors since January.

That trendline marked the higher boundary of a falling wedge sample, which is commonly considered as a bullish reversal sign. The worth additionally stays above each the 50-day and 200-day Exponential Transferring Averages and has fashioned an inverse head and shoulders sample.

Given these indicators, XRP is more likely to proceed climbing, with an preliminary goal round $3.40, the year-to-date excessive, which represents about 53% upside from present ranges. Nevertheless, a drop under the 200-day EMA at $2 would invalidate the bullish outlook.